CRM for banking

The only thing most large financial institutions struggle with is monitoring their documentation. The larger the business, the more documents it has to deal with, and it is often the employees who are responsible for managing client files. However, this work can prove not only challenging and error-prone, but also incredibly tedious, leading to documentation errors, poor maintenance, and insufficient respect for client time. As expected, all this has one thing to do: losing clients and reducing revenue.

Fortunately, there is only one solution to your problems and it is known as customer relationship management (CRM) systems. In addition to preventing unwanted results, a CRM system can also increase your bank’s ratings and revenue by significantly improving your employees‘ performance and company efficiency.

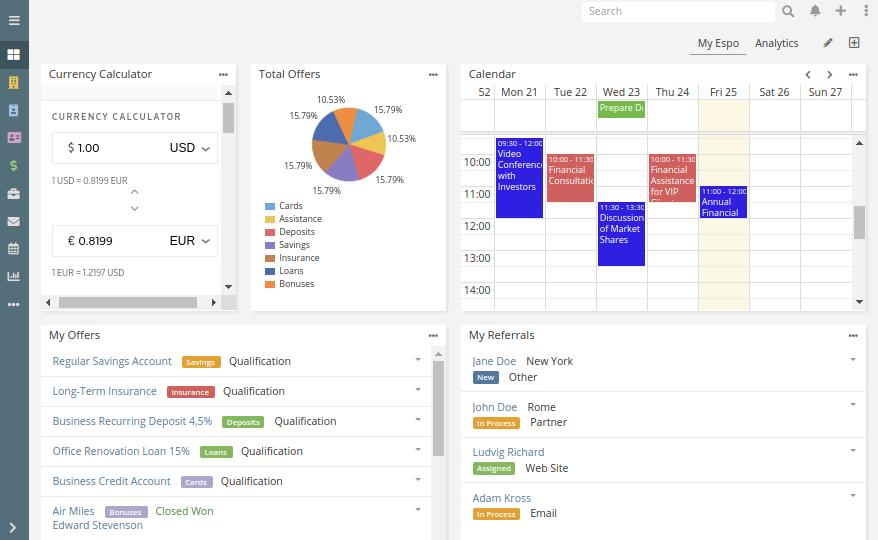

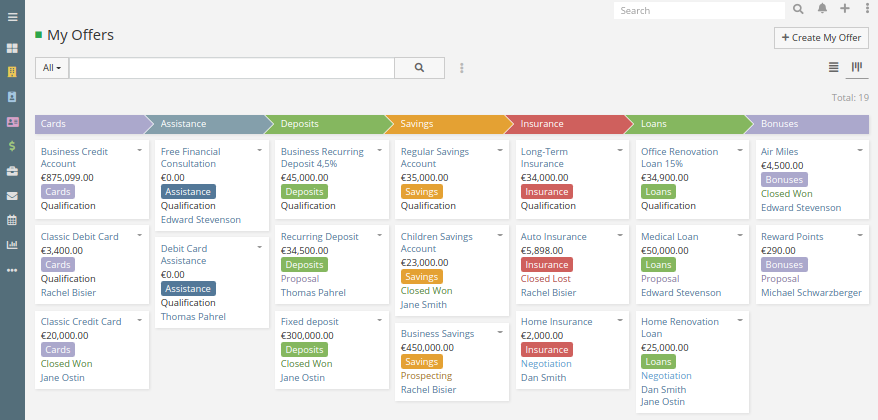

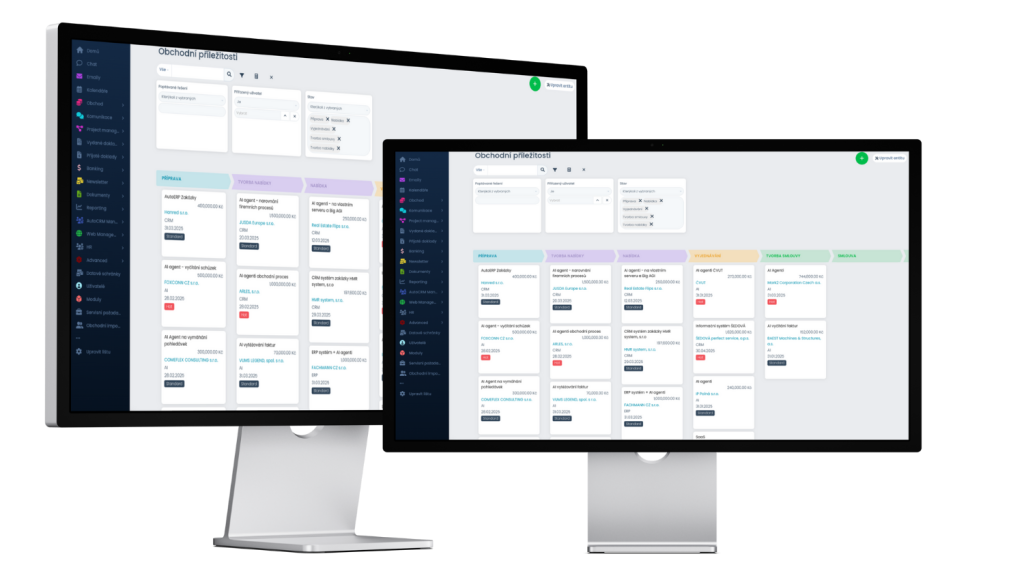

What you can find in CRM and is suitable for financial institutions:

- clear CRM suitable for larger business teams

- document management system

- call recording – the possibility of transcribing into a document

- project management

- bonus system

- commission system

- synchronization of all e-mail and telephone documentation to the client

- system of rights

- clear charts for company management

- and lots more.

So what can a CRM program do for companies in the banking sector?

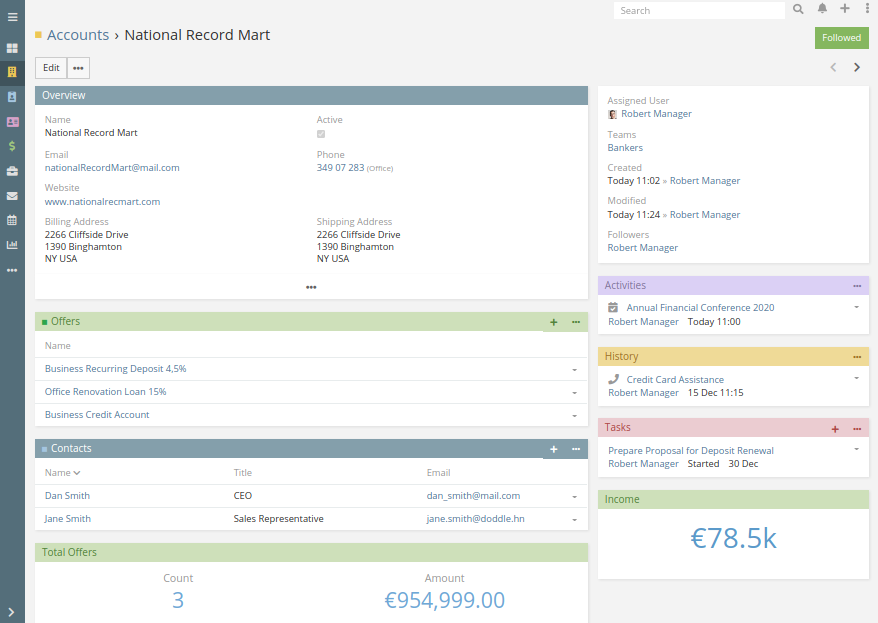

The CRM system first stores all your client information in a single database. Because this process is fully automated, it means excellent accuracy and greater efficiency, as well as ensuring that each of your customers receives due attention. By relying on a single database, you can ensure that your employees can quickly find all the relevant information about any client they deal with without wasting their client’s time and time.

In addition to efficiently storing customer information, the CRM system can also analyze client activity and help you tailor your approach to each customer. This will allow you to provide relevant information and details that are of particular interest to your client. An individual approach will ensure that your clients feel treated and will also ensure that none of your emails are thrown directly into the „spam“ folder. In addition, this thorough analysis will help you identify the most promising customers, divide them into different categories and assign them permissions.

In fact, the main advantage of CRM is that it is a fully automated system. Human employees are prone to errors and mistakes that can be minimized and completely eliminated when you implement a CRM system in your institution. It automates the processes of the entire organization, which results in increased accuracy and precision and excellent clarity. This basically means that all important operations, such as loan approval, will run smoothly and efficiently without being adversely affected by human error.

In addition, the CRM system allows you to expand your customer base by attracting company employees such as business partners, suppliers and customers. It also improves the overall organization of your employees and takes care of all quality control responsibilities, while providing effective motivation for your managers when it comes to customer service. This means that by implementing a CRM system, you can not only improve the accuracy, precision and efficiency of your company, but ultimately bring new clients to the bank, increase the client retention rate and significantly increase your revenue.